|

May 1, 2017 May 1, 2017

Why financial advisors are not doing these four things?

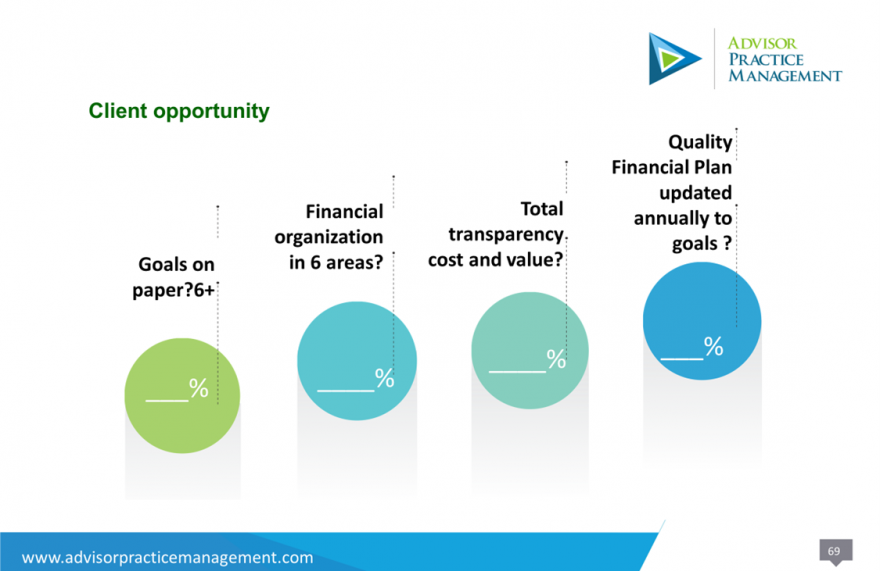

Every wealthy client usually has a financial advisor. But in my workshops with financial advisors, it seems every advisor has a tremendous opportunity to acquire more wealthy clients from their competition. That is because when I ask most advisors these four questions, rarely is anyone doing all four things with their ideal clients. The four questions to ask a wealthy prospect are:

Complete-Would it be valuable to have your financial life completely organized in the following areas, tax planning, estate planning, risk management, debt planning , insurance planning and wealth management?

Goals- Would it be valuable to get clarity around all of your goals for today and for tomorrow and get 6-10 goals on paper, track them, and put a plan together to reach them?

Fee audit- How do you feel when you are paying for something and not getting it? Do you know the complete cost for everything you are paying for from your advisor and getting and not getting? Would a fee audit showing the cost of advice, money management and planning and what you get and don’t get be valuable to you?

Quality financial plan- What does a quality financial plan mean to you? Do you have a quality financial plan? Would you like one?

Simple questions to start an engaging conversation. Do your best clients have all 6 areas organized? Do your ideal clients have more than 3 goals tracked and updated in a quality financial plan? Do they know what they are getting for the fees they are paying?

How many people you know have their financial life completely organized? It’s fine to laugh when I ask this question because most people don’t have the time to organize everything. But’ what if you could be completely organized in all of the key planning areas including tax planning, estate planning, risk management, investment management, debt management and insurance planning? What would that give you? More time to do the things you want to in life, knowing that your plan is there to guide you to make solid financial decisions in your life.

Start with goals

How many goals do you get from your clients? Besides the major retirement goal, do you get other clients goals such as family or parents healthcare, home renovations or changes, education, estate planning, gifts donations or charities? A typical advisor gets less than 3 goals while client driven plans get 7 or more goals. Looking at the goals list below, how many goals can you check off?

Goals Based Planning Exercise

____ Lifestyle - Retire / slow down / part time

____ Debts- Debt reduction-debt free

____ Education – Children / Self

____ Vehicles – Cars / Boat / RV / collector

____ Major purchase – Vacation property / Lifetime Trip

_____ Travel -Vacation property / Trips / bucket list

____ Health care – Family members / personal health

____ Home – Reno’s / Upgrades / downsizing

____ Celebrations- Weddings / birthdays

____ Estate- legacy- family-wishes

____ Gifts- donations / charitable involvement

____ Bequests – Philanthropic goals / legacy

____ Care for someone – elderly / family

____ Business – Investment / opportunity

____ Career – education / changes / courses

____ Memberships / Hobbies – golf or sports clubs / groups / collections

Whenever I share this list with advisors in my workshops, they usually add to the list. Go ahead, make it your list and put it in front of your clients and prospects and ask them this question” looking at this list, is there any goal that jumps out to you that you have been thinking about?”.

What data is missing?

I hate factfinders, they are painful and boring and are not engaging. Finding out their personal income by finding out more than one goal will help you gather the information. If you get more than 6 goals from a client, you are well on your way to gathering critical financial planning information. However, what sometimes missing in financial plans are life expectancy, personal health information including smoking, net worth and other assets or liabilities list such as business assets or liabilities, stock options and deferred compensation options. What risk data or software do you use and does it include insurance risks such as life and disability insurance, long term care needs and longevity risk along with market risk and inflation risk.

What do your clients expect?

While clients may feel confident in the value you deliver, and what they pay for the value, delivering more will eventually become commonplace. As Warren Buffet said” Price is what you pay. Value is what you get.”. What is a quality financial plan? What is the value of having a quality financial plan? How often do clients want their financial plans updated or discussed? These are great questions to ask your best clients who are paying thousands of dollars to you and your firm. Some advisors and clients do not see the value of having a quality financial plan. The days of drafting a large financial plan consisting of 30-50+ pages and then putting it on the shelf and never looked at again may be over.

Fee audit

How do you feel when you are paying for something and not getting it? Financial advisors are using letters of engagement that list all of the things they are promising to clients. They were written 5 years ago and when you look at what they promise to deliver on an annual basis, and what they are doing for clients, it is easy to ask the question, what are you getting and not getting? The focus is on the relationship. A simple checklist to help people get their complete picture organized is like doing an annual home inspection to keep your home, in perfect condition, to make sure it holds it’s value. I completed the “No stone unturned annual checklist” of 100 plus things to get people up to date in the six areas. Tax planning, estate planning, risk management, debt planning, insurance planning and wealth management?

What does a quality financial plan mean to you?

This is a great question to ask your ideal clients, your staff, your own family members and most importantly, yourself. Start by defining what a quality financial plan means to you. Is it comprehensive? Is it coordinated with other professionals? Clients want to know, am I going to be ok and meet my goals, and am I on track. Delivering these answers is not easy, however, can become easier with a quality financial plan.

Create your consistent process to building more value and attract your new ideal clients.

Grant Hicks, CIM, is President of Advisor Practice Management and co-author of “Guerrilla Marketing For Financial Advisors” 1st and 2nd edition. www.advisorpracticemanagement.com for speaking or workshops for financial advisors, contact Grant at grannt@advisorpracticemanagement.com For coaching contact grant at grant@ghicks.com

For a copy of our guide the" Future Ready Financial Advisor" go to http://www.advisorpracticemanagement.com/resources or http://futurereadyfinancialadvisor.subscribemenow.com/

Advisor Practice Management’s goal is

“ Helping Financial Advisors take action, to create 100 quality financial plans for their clients”. My mission if you choose to accept it is “ To help advisors to create 1 million quality financial plans for people”. Ask your clients and prospects this question " What does a quality financial plan mean to you? Let me know if I can help you grow your practice.

Let’s work on your business. Start by emailing us. Why not?

Enthusiastically yours,

Grant Hicks, CIM, National Director Practice Management

Advisor Practice Management

www.advisorpracticemanagement.com

909-17th Ave SW, 4th Floor

Calgary, Alberta T2T 0A4

Tel 587 390 3148

Cell 403 970 8895

Email grant@ghicks.com

PS Where do you want to be in 3 years?

STATEMENT OF CONFIDENTIALITY The information contained in this email message and any attachments may be confidential and is intended for the use of the addressee(s) only. If you are not an intended recipient, please: (1) notify me immediately by replying to this message; (2) do not use, disseminate, distribute or reproduce any part of the message or any attachment; and (3) destroy all copies of this message and any attachments.

|