|

June 26, 2024

Is your marketing compelling or the same as every other financial advisor?

Is your marketing compelling or the same as every other financial advisor?

The word “compelling” means having a powerful and irresistible effect, requiring acute admiration, attention or respect. It also means very exciting and interesting and making you want to watch or listen. Are your offers to ideal high-net-worth prospects compelling? Elite financial advisors know they have to offer something compelling to get high-net-worth peoples attention.

What are you offering?

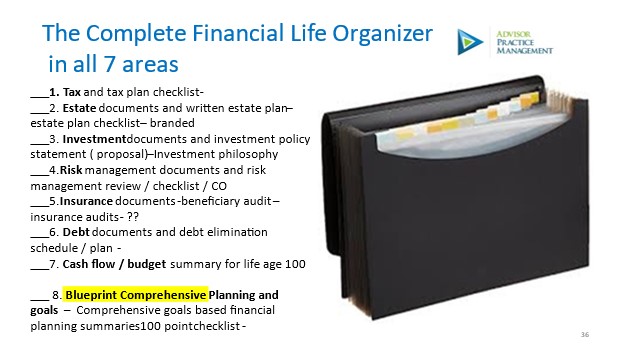

Every financial advisor website I go to offers the same thing, in the same way, and is NOT compelling. Compelling offers come in many ways. One way is to ask really deep engaging questions to high-net-worth people to engage them. Another way may be to share a picture which is worth more than words. Let me share one example. See the graphic. How many people do you know that are completely organized in all 7 areas of their financial life with a comprehensive plan that covers all 7 areas?

Then if we add a link to a video that explains the offer and a signup or landing page ( all with compliance approval of course) to get a guide to organizing your finances along with a sample comprehensive plan, this can be one compelling offer. You combine different communications, email, picture, video, social media, websites, and landing pages to make this a simple offer into a compelling offer. The key to it is the effect. When we combine different mediums the effect increases. Finding the right media mix is the hard part and that takes time.

What are your offers?

Is it time to update your website, emails, or online offers? What are your offers and what do I get as a potential ideal client? Do you have one clear offer to your best prospects? If your offer is not clear and compelling, how about your other offers? It is time to ask yourself what is working. This is where most financial advisors get frustrated with marketing. They know that their marketing is not working as well as they would like. They end up talking to an elite financial advisor and discover that the offer is similar, but the elite advisor has several offers that are clear and compelling, and they know they need to change their offers. Then they never implement because it takes time effort and imagination. Guerrilla Marketing for Financial Advisors , ( Morgan James Publishing, written by myself and Jay Conrad Levinson) is all about investing the right time energy, and imagination not necessarily money into growing your business. Carve out 2 hours per week to work on your business, or delegate this to your team to do.

Elite advisors use their voice

Working with elite financial advisors, I know that they use video, podcasting, radio, or a medium to share their voice. This gives their clients confidence when they hear from their advisor, even without meeting with all of them one on one. This also gives prospects the opportunity to meet with someone who they might do business with in the future. Think this through. If I was an ideal prospect who was mildly happy with my current advisor, Why would I listen to you? Because you have an irresistible and compelling offer that I am not currently getting. Now I would want to know what I don’t know ( I did not know I am not currently organized and I have never seen a comprehensive plan covering all 7 areas) so I go from I don’t know what I don’t know to now I know what I don’t know. The next step is talking one on one with you. How will I have an opportunity to do that? It may be as simple as an online calendar form, or invite you to an event to meet at such as an online Zoom or live event. Once I meet with you, and I learn more about what I am not getting from my current financial advisor, the decision to fire my current advisor is done, it is a matter of who I will hire as my new advisor. The odds are now in your favor to onboard a new ideal client.

Where do you want to be in three years?

Our Practice Management resources - Comprehensive Practice Management checklist

https://practicemanagement.getresponsepages.com/

Sample: Comprehensive Financial Advisor Practice Management benchmarking report

Key data and KPI's, over 30 Key Performance indicators. Do want a sample benchmarking report to help you understand how to get the edge on your practice and your competition?

https://benchmark.getresponsepages.com/

Updated 2024 Technology Checklist for Financial Advisors

This checklist is five years' worth of research on the best processes elite financial advisors and their teams implement to acquire and service ideal clients while running an efficient practice.

https://technology-checklist.getresponsepages.com/

We are here to serve your practice, let’s talk

Contact us to help get clarity around your goals on paper, and have the goals conversation by contacting Grant at grant@ghicks.com or click on the link to set up a no-obligation 20-minute discussion https://my.timetrade.com/book/JMTNJ regardless if we work together, let’s have a chat and listen to your biggest practice management concerns to help you get clarity around your future business.

Grant Hicks, CIM, is President of Advisor Practice Management and co-author of “Guerrilla Marketing For Financial Advisors” 1st and 2nd editions. www.advisorpracticemanagement.com for speaking, workshops, or coaching, contact Grant at grant@ghicks.com Grants combined financial advisor clients manage over 7 billion AUM, and earn over $70 million dollars combined!

Enthusiastically yours,

Grant Hicks, CIM, President

Advisor Practice Management

www.advisorpracticemanagement.com

PO Box 382 Lantzville BC V0R 2H0

Cell 403 970 8895

Email grant@ghicks.com to book a meeting click here https://my.timetrade.com/book/JMTNJ

PS Where do you want your financial practice to be at the end of 2025? AUM, Revenue, and time off?

STATEMENT OF CONFIDENTIALITY The information contained in this email message and any attachments may be confidential and is intended for the use of the addressee(s) only. If you are not an intended recipient, please: (1) notify me immediately by replying to this message; (2) do not use, disseminate, distribute or reproduce any part of the message or any attachment; and (3) destroy all copies of this message and any attachments.

|