|

January 2 , 2017 January 2 , 2017

Regulatory change is here and your clients are not ready for it!

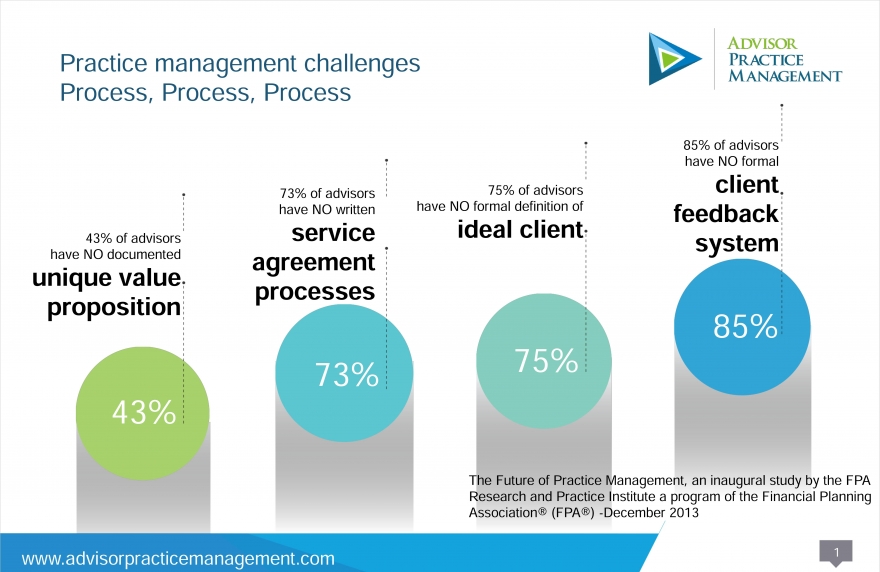

Can your clients explain the total cost of all the fees they pay ( in dollar terms) and what they get for those fees ( your value promise) with clarity? With major regulatory changes and the emergence of robo-advisors in the fintech world, now more than ever in history has it been more important for financial advisors to be able to clearly articulate what clients pay and what clients get for what they pay. But clients who have never had these conversations before may not understand their new statements. In other words, “how do you explain to a client, what I pay in dollar terms and what I get in value terms? The three keys in articulating your value are critical conversations you have had with a client. As the saying goes, the three keys to success in real estate is location, location, location. In practice management for financial advisors the three keys to success is process, process, process. The advisors who have proven processes to articulate their value, do significantly better than advisors who lack critical processes. Clients will see the new CRM2 statements in Canada and American advisors will be dealing with the DOL Fiduciary rules.

We know that 43% of advisors do not have a documented value promise ( The Future of Practice Management, an inaugural study by the FPA Research and Practice Institute a program of the Financial Planning Association® (FPA®) -December 2013 ) That means that 43% of clients may not understand the value they receive for the fees. There are 3 keys to getting your clients ready in 2017.

Getting clarity, the first key

Can your clients articulate the value you deliver? Getting clarity around what you do and your process to deliver value, you must have a documented process. To answer the question what do I get for $5000, $10,000 or more per year? In workshops, when I ask advisors the question, what do I get for $10,000 per year, most advisors are answering the question off the top of their mind. If the advisors are winging the answer, you can bet their clients are also. The next question in the workshop helps advisors get more clarity. The next question is” what do I get for $20,000 per year?” Usually it is the same answer as the last one, and comes off the top of their mind. If clients cannot answer these questions, have they even had this discussion before? This is where clarity comes in. It is not the amount that I pay, it is the value I receive for what I pay. Do you have it in writing and can you clearly articulate what value I receive? Building a value promise, a written document which is the first process to help advisors clearly articulate the value clients receive and your process to deliver it so clients can understand and remember it. This is an ongoing process, so you can constantly improve the value you deliver and deliver more and more value. Start by putting it in writing, having the critical conversations with your ideal clients and asking if they want a copy. This will tell you if they understand it and think it’s a valuable document.

The written process, the second key

After the process is documented, you must have it scripted for clarity . Have you had these critical conversations with your clients? Is the conversation consistent or do you wing it? Once you have the value that you deliver to clients in writing, have it scripted or written out so you can hear how it sounds as if you were a client. Does it make an impact on you, or does it sound like something every other advisor would say? What questions do you ask to help people get clarity around their finances and goals? What type of outcomes am I looking for and willing to pay for as a result of your work? For the most part, we think it is our job to ask questions and for clients to supply the answers. But what happens when the tables are turned? Would we make any sense? Or would our answers tumble out incomplete and unclear?

Your value promise document takes on the seldom considered idea that your clients ask an awful lot of questions. Especially now since they are seeing new reports. Simply put, the questions of your clients reveal what is important to them, what they want, what they wanted to know of us and from us, and what they want to happen, the outcomes they are searching for. Their questions reveal their greatest intents. Ultimately, though, the questions of our clients reveal what we ourselves should be asking. That is, if we are brave enough. Are we?

Clarity through conversations, the third key

In my workshops, I ask advisors to write down three to five things of value, your best clients are willing to pay for and holds great value to them. Rarely if ever, advisors write down what I consider three critical words to explain their value. The words are conversations, exercises or discussions. No matter what you call it, having key conversations with clients about important areas in their life so they can gain clarity is valuable. When was the last time someone sat down with you, really listened to you and really understood you? The value is in the conversations ( or call them exercises or discussions) you have. Think about this. One of your values is to help people gain clarity around their financial goals for their future, through your conversation. Can people do it on their own? Yes ! Do their get a deeper understanding of their financial goals and put it down on paper. Sometimes. Do they sit down with their spouse and get clarity around where they are going together? They gain a deeper, more objective insight into where they have been and the new direction that will bring clarity to their lives. Again, the value is in the conversation. I would encourage you to ask this question. Would it be valuable to get clarity around your goals for the future and put it on paper?

Schedule the conversations with your clients

With the rise of #fintech and robo-advisors, how many of those robo-advisors would be able to have a valuable conversation or discussion to help people gain financial clarity? Start by getting clarity around the value you deliver for clients and put it on paper. Then clearly articulate it and describe your value. Part of your value is in your conversations. Now you have the three keys to articulating your value, which will give your clients and prospects more clarity, and more importantly, you. Clarity in writing of the fees ( total transparency) and the value you deliver, a mastered script to articulate your value and critical conversations so that your clients can articulate what the fees are and more importantly what they receive for the fees they pay. This is when clients are ready for changes.

If you would like more information about financial advisor workshops or coaching to build your value promise process, email us at grant@advisorpracticemanagement.com

For a copy of our guide " Future Ready Financial Advisor" go to to http://www.advisorpracticemanagement.com/resources or http://futurereadyfinancialadvisor.subscribemenow.com/

For more information on how to become CRM2 ready for 2017, email us for the Practice Management checklist at: grant@ghicks.com

Advisor Practice Management’s goal is

“ Helping Financial Advisors take action, to create 100 quality financial plans for their clients”. My mission if you choose to accept it is “ To help advisors to create 1 million quality financial plans for people”. Ask your clients and prospects this question " What does a quality financial plan mean to you ? Let me know if I can help you grow your practice.

Let’s work on your business. Start by emailing us. Why not?

Enthusiastically yours,

Grant Hicks, CIM, National Director Practice Management

Advisor Practice Management

www.advisorpracticemanagement.com

909-17th Ave SW, 4th Floor

Calgary, Alberta T2T 0A4

Tel 587 390 3148

Cell 403 970 8895

Email grant@ghicks.com

PS Where do you want to be in 3 years?

STATEMENT OF CONFIDENTIALITY The information contained in this email message and any attachments may be confidential and and is intended for the use of the addressee(s) only. If you are not an intended recipient, please: (1) notify me immediately by replying to this message; (2) do not use, disseminate, distribute or reproduce any part of the message or any attachment; and (3) destroy all copies of this message and any attachments.

|