|

January 04, 2021 January 04, 2021

Acquiring more ideal clients in 2021, financial advisors will need to think differently

Acquiring more ideal clients in 2021, financial advisors will need to think differently

Financial advisors looking to acquire more ideal clients this year will have to think differently. here are a few ideas to help you think differently. The first thing financial advisors will need is a list of potential opportunities. This can come from existing clients prospects centers of influence or other databases. The next thing is to define who your ideal clients are? Finally, how are you going to connect with these opportunities if the pandemic continues well into 2021?

Finding ideal prospects

if you are looking for wealthy retirees and are struggling to build your database and connect with more people then consider sales navigator from LinkedIn. When you learn how to do searches on sales navigator you can type in retired and look at the different groups of retirees in different occupations ad targeting those people to your webinars or other marketing to find meet and acquire as ideal clients. A quick search and you will find that a lot of people put retired as their occupation in LinkedIn. Now you have the ability to connect with thousands of potential retirees in your target market and clearly defining the types of retirees you want to work with.

Focus on Ideal families, not clients or households

The most common mistake I see when financial advisors segment their clients is they do not clearly define who their ideal families are. What I mean is that they do not have the data on the client to tell them if there are other family members they should be connecting with. For example, are you having family conversations with your clients to find out more about their parents their siblings their children, and other family members? In one of my future blog posts, I will share key strategies on how to have valuable family conversations, and critical questions to ask.

The next time you segment your database make sure you understand if there are potential wealthy family members that you see as a potential opportunity as an ideal client. If you cannot answer that question then I think you should set up a conversation with your clients to discover if there are other family members that you should be having conversations with because you already have trust with them. Start thinking beyond clients and households and change your language to ideal families. Imagine if you worked with 50 ideal families? Ideal clients pay $5000 to $10,000 or more per year. How much do ideal families pay, all in? Each ideal family is potentially paying $10,000-$50,000 or more per year.

Does mail still work?

Financial advisors looking to target certain people such as retirees may have to think out of the box to connect with these types of people. We know that a majority of the retirees control a majority of the wealth so targeting people that are age 60 and over who are retired is not as easy as during the pandemic. Building trust online with wealthy retirees has not been easy for the wealth management industry. The financial advisors that have been the most successful have also been the most creative when it comes to targeting wealthy retirees. Some examples of these creative advisors include Mail drops to retirees to target their webinars. it also includes sending out postcards as no one uses postcards anymore. The postcard stands out and people hold onto the postcards because it has the date-time and information on the webinar or event. These financial advisors are using what I call the five touch philosophy to connect with wealthy retirees.

The law of familiarity

You see it as a combination of five communications that help people build the law of familiarity around who you are, what you offer, and what they are currently not getting from their financial advisor or institution. These five touches may include a website, webinar, or event, email, a value-added offer such as a workbook guide checklist or digital engagement tool, and a chance to meet someone and still be anonymous. these five touches taken ideal wealthy retiree from I don't know what I don't know two now I know what they don't know. in other words, they now see what they are missing and at the same time meeting with someone who can deliver more value. A good example of this is offering a fee audit webinar 2 wealthy ideal prospects. If you would like a copy of our fee audit guide then click https://feeaudit.getresponsepages.com/ It is these creative advisors that are seeing that this is a once in a lifetime opportunity to grow their business biunique be different and acquire more ideal clients.

Comprehensive practice management

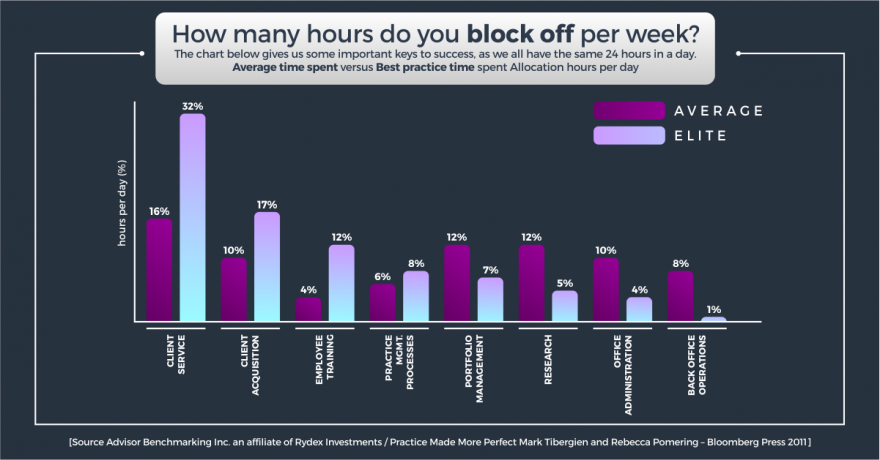

What is the probability of success in reaching your business goals with your current business plan? 70-80%? Does it cover all areas of practice management?

While each financial advisor's practice may have a different approach, advisors need to understand where their practice needs help, and will they get the right help for the right part of their practice. What areas does your practice need help with? Get a copy of our updated 21-page “Comprehensive Practice Management Strategies checklist” by going to our website https://www.advisorpracticemanagement.com/about-us or clicking here https://practicemanagement.getresponsepages.com/

Call me

Contact us to help get clarity around your goals on paper, and having the goals conversation by contacting grant at grant@ghicks.com or click on the link to set up a no-obligation 20-minute discussion https://my.timetrade.com/book/JMTNJ regardless if we work together, let’s have a chat and listen to your biggest practice management concerns to help you get clarity around your future business.

Grant Hicks, CIM, is President of Advisor Practice Management and co-author of “Guerrilla Marketing For Financial Advisors” 1st and 2nd edition. www.advisorpracticemanagement.com for speaking, workshops, or coaching, contact Grant at grant@ghicks.com Grants combined financial advisor clients manage over 4 billion AUM, and earn over $40 million dollars combined!

Enthusiastically yours,

Grant Hicks, CIM, President

Advisor Practice Management

www.advisorpracticemanagement.com

Suite 1625-246 Stewart Green, SW

Calgary, Alberta T3H 3C8

Cell 403 970 8895

Email grant@ghicks.com

PS Where do you want to be in 3 years?

STATEMENT OF CONFIDENTIALITY The information contained in this email message and any attachments may be confidential and is intended for the use of the addressee(s) only. If you are not an intended recipient, please: (1) notify me immediately by replying to this message; (2) do not use, disseminate, distribute or reproduce any part of the message or any attachment; and (3) destroy all copies of this message and any attachments.

|