|

February 17, 2025

Collecting and managing data for financial advisors, there has to be a better process?

Collecting and managing data for financial advisors, there has to be a better way

It's Tuesday morning and you have an ideal prospect meeting where you collect some data to potentially onboard a new ideal client. The new prospect is excited to see what you can come up with to help them and their financial future and you're excited to start developing plans and strategies to help them achieve their goals. What is holding both of you back from proceeding and having a seamless prospect experience that transforms into an ideal client experience? The relevant data is to be imported and exported into potentially six different technology systems.

Organizing the client and data capture

Every financial advisor has a process such as a fact finder, data gathering worksheets, online portals, or uploaded information to capture the information and data to become a client. The first problem is did you collect all of the data that you need to onboard the client or did you get just enough to open accounts? Now you have to take that data and put it into your CRM system. From the CRM system, you know how to enter that data or transfer it to your financial planning software. Some financial advisors use more than one software system, so does the data transfer to all financial planning software and portfolio management systems? This is where financial advisors discover they need more information, while they're preparing comprehensive planning and advice to deliver. Information in all seven areas including taxes estate investment risk insurance debt and cash flow. Getting copies of tax returns uncovers a lot of data, and yet some firms do not allow the collection of tax returns. Always check with branch management and compliance before proceeding with any marketing activity.

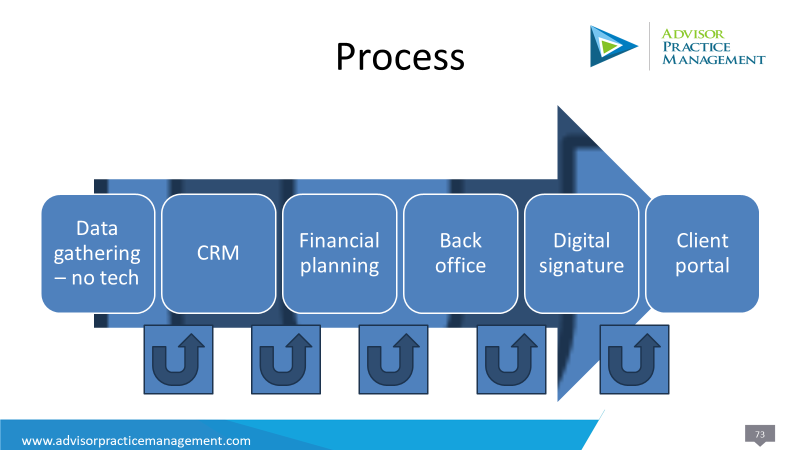

What are the six technologies?

You might collect the data electronically through a secure e-mail system or an online portal or software. Then you transfer the data to your CRM system. Next, it's your financial planning software. Then the data has to be populated in your back office system. Next, it has to be organized in an e-mail in a digital signature system. Finally, information goes to a client portal system that is set up.

- Data gathering system

- CRM

- Financial planning and portfolio management software

- back office systems

- digital signature systems

- client portal systems

Does the data flow seamlessly and confidentially between all six systems? I am no technology expert nor do I work for or represent any technology companies. I'm simply trying to help financial advisors in their clients look at how the onboarding process can be potentially improved making it a better experience for the clients and building efficiency for financial advisor teams. I'm fortunate to work with elite advisors and elite financial teams with solid software and systems in place, and we work on improving data collection and helping people get organized in all seven areas of their financial lives.

What is your process for data collection?

As a financial advisor do you have a proven scripted process to collect the information and give it to your team to input into your systems? Do you have a pair planner or someone who can put the data and draft financial and wealth management plans? Data collection and input take a tremendous amount of time and organization. Your job as a financial advisor is to understand the client and help organize their financial life in all 7 areas. It engages people to do more comprehensive planning and more comprehensive advice. This is where you do your best work as a financial advisor. What part of the process do you need to improve on for ideal client acquisition?

Would you like a copy of our Comprehensive Practice Management Checklist for financial advisors?

How About Your Goals for Your Practice in 2025?

While each financial advisor's practice may have a different approach, advisors need to understand where their practice needs help, and will they get the right help for the right part of their practice. What areas does your practice need help with?

Free Resources:

21 Page Technology Checklist to Become a Future-Ready Advisor

Fee Audit Checklist for Ideal Prospects

We are here to serve your practice, let’s talk

Contact us to help get clarity around your goals on paper, and have the goals conversation by contacting Jeff at jeff@jeffthorsteinson.com

Regardless if we work together, let’s have a chat and listen to your biggest practice management concerns to help you get clarity around your future business.

To book a NO obligation conversation with me to discuss practice management or coaching click the following link https://calendly.com/jeffthorsteinson/30-minute-q-a-explore-apm and let’s talk.

Jeff Thorsteinson, Grant Hicks and Advisor Practice Management's combined financial advisor clients manage over 8 billion AUM, and earn over $80 million dollars combined!

Schedule Appointment

Visit www.advisorpracticemanagement.com for speaking, workshops, or coaching, contact us below.

STATEMENT OF CONFIDENTIALITY The information contained in this email message and any attachments may be confidential and is intended for the use of the addressee(s) only. If you are not an intended recipient, please: (1) notify me immediately by replying to this message; (2) do not use, disseminate, distribute or reproduce any part of the message or any attachment; and (3) destroy all copies of this message and any attachments.

|